June Jobs Up Nearly 5 Million; Unemployment Rate Drops; New Claims at 1.4 Million

The Bureau of Labor Statistics reported total nonfarm payroll employment jumped by 4.8 million in June, as easing of coronavirus restrictions brought back more workers who had been laid off earlier this spring.

In a separate report, the Labor Department reported an additional 1.4 million Americans filed initial unemployment claims last week—evidence that the economic fallout from the coronavirus pandemic continues to have long-reaching effects.

The report came out one day earlier than normal because of the Independence Day holiday, which was observed on Friday, July 3.

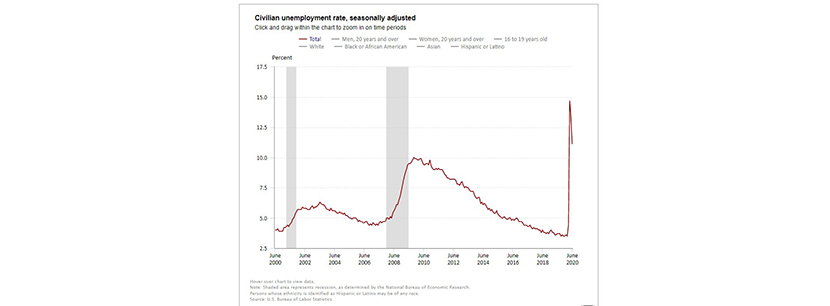

BLS said the unemployment rate fell by 2.2 percentage points to 11.1 percent and the number of unemployed persons fell by 3.2 million to 17.8 million. Although unemployment fell in May and June, the jobless rate and the number of unemployed are up by 7.6 percentage points and 12.0 million, respectively, since February.

The report said employment in leisure and hospitality rose sharply. Notable job gains also occurred in retail trade, education and health services, other services, manufacturing, and professional and business services. The labor force participation rate increased by 0.7 percentage point in June to 61.5 percent, but is 1.9 percentage points below its February level. Total employment, as measured by BLS, rose by 4.9 million to 142.2 million in June. The employment-population ratio, at 54.6 percent, rose by 1.8 percentage points over the month but is 6.5 percentage points lower than in February.

“[Thursday’s] jobs report shows that our resilient economy continues to return more people to work, more quickly, than forecast,” said Labor Secretary Eugene Scalia. “It is heartening to see employment gains across nearly all demographics. The report reflects that we can return millions more Americans to work in the weeks ahead, provided we bear in mind that economic recovery must go hand-in-hand with safe practices and self-discipline.”

Mike Fratantoni, Chief Economist with the Mortgage Bankers Association, said the job market “recovered at a much faster than anticipated pace in June, with strong job growth and a surprisingly large drop in the unemployment rate. 7.5 million people returned to work in May and June following a temporary layoff, which is quite a rebound. However, there are still 10.6 million people with this status, and the longer they remain out of work, the greater the risk that their situation becomes permanent. We are also continuing to see a very high level of new layoffs, with 1.4 million initial claims for unemployment insurance last week.”

Fratantoni said the report “is nothing but positive for the housing and mortgage markets. The stronger job market will support new home purchases, as well as helping homeowners make their mortgage payments. MBA continues to believe that Congress needs to extend enhanced unemployment insurance benefits to support those households that remain unemployed. Although this surprisingly strong report will put some upward pressure on interest rates, we do not expect it will change the Fed’s commitment to keep rates at zero for the foreseeable future.”

Jay Bryson, Chief Economist with Wells Fargo Securities, Charlotte, N.C., said June’s gains likely won’t be repeated in the next few months due to recent re-acceleration in COVID-19 cases.

“The labor market still has a long way to go to recoup the 22 million jobs that were lost in March and April,” Bryson said. “Nearly 18 million individuals are currently classified as unemployed. In February, fewer than six million were jobless when the unemployment rate stood at only 3.5%.”

Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif., agreed. “The June jobs report appears to be good news for the economy but labor market improvements are likely to stall out if we don’t get control of the virus,” she said. “Stay-at-home orders and mandated business closures have disproportionally impacted the services sector, which is why we saw a strong rebound in leisure and hospitality employment in the May and June reports as states began to re-open. Yet, more than 40 percent of the country is now reversing its plans to reopen, and this could potentially result in another labor market shock.”

Kushi added the report bodes well for housing, with a caveat. “The housing market has been one of the few sectors to experience a true V-shaped recovery, however, the course of recovery is partially dependent on the health of the labor market,” she said.

Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C., noted residential construction employment (including specialty trade contractors) grew by 83,000 in June, “a smaller gain than last month but a welcome sign nonetheless for an industry grappling with supply constraints.”

BLS reported average hourly earnings for all employees on private nonfarm payrolls fell by 35 cents to $29.37 in June. Average hourly earnings of private-sector production and nonsupervisory employees decreased by 23 cents to $24.74 in June. The decreases in average hourly earnings largely reflect job gains among lower-paid workers; these changes put downward pressure on the average hourly earnings estimates.

The report said the average workweek for all employees on private nonfarm payrolls decreased by 0.2 hour to 34.5 hours in June. In manufacturing, the workweek rose by 0.5 hour to 39.2 hours, and overtime was unchanged at 2.4 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls fell by 0.2 hour to 33.9 hours. “The recent employment changes, especially in industries with shorter workweeks, complicate monthly comparisons of the average weekly hours estimates,” BLS said.

Meanwhile, Labor on Thursday reported the advance figure for seasonally adjusted initial claims for the week ending June 27 fell slightly to 1.427 million, a decrease of 55,000 from the previous week’s revised level. The four-week moving average fell to 1.504 million, a decrease of 117,500 from the previous week’s revised average.

The advance seasonally adjusted insured unemployment rate—also known as “continued claims”—was unchanged at 13.2 percent for the week ending June 20. The advance number for seasonally adjusted insured unemployment during the week ending June 20 rose to 19.29 million, an increase of 59,000 from the previous week’s revised level. The four-week moving average fell to 19.85 million, a decrease of 494,500 from the previous week’s revised average.

“Although down significantly from the 6.9 million claims that were filed in the last week of March, the number of first-time filers remains inordinately high,” Bryson said. “Moreover, the number of individuals who continue to receive unemployment benefits remains elevated at roughly 19 million.”

“The pace of improvement in both of these indicators appears to have slowed in recent weeks,” Duncan said. “Furthermore, states reported processing about 13.6 million continued claims for benefits available from emergency compensation programs enacted as part of the CARES Act for the week ending June 13. This figure is not included in the regular continued claims number, and is about 1.7 million higher than the previous week.”